How to Make Money Churning Bank Accounts: Complete Guide

When I first heard about people making serious cash just by opening and closing bank accounts, I thought it sounded too good to be true. Bank account churning is not only legitimate, but it’s also one of the most straightforward ways to earn extra money without selling anything. So, how do you make money churning bank accounts?

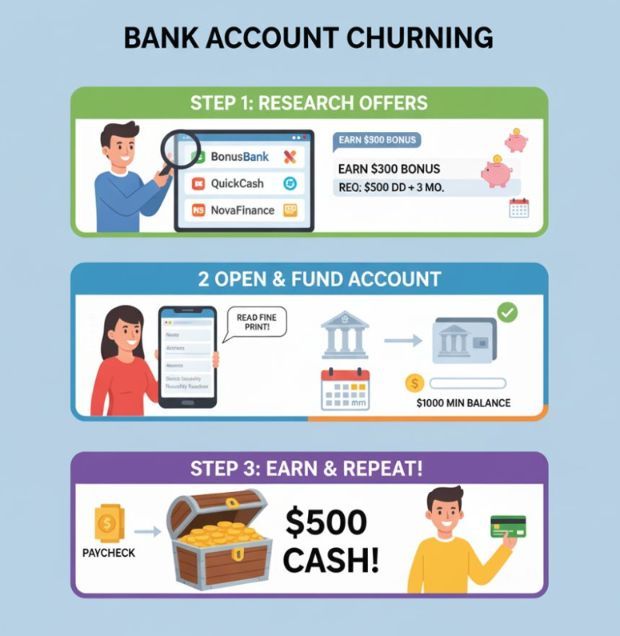

Start by making a list of online banks that offer cash bonuses. Open new accounts and meet the requirements to receive the bonus, such as a minimum deposit required or time period to keep the account open. Then, when you have collected the bonus, close the account or maintain the account per the terms. Repeat with different banks while tracking taxable bonus income and avoiding fees or credit score impacts from excessive inquiries.

In this guide, I’ll walk you through everything you need to know about making money through bank account churning. Whether you’re trying to fund a vacation, build up your emergency fund, or just like the idea of free money (who doesn’t?), this strategy could put hundreds—or even thousands—of dollars in your pocket this year.

What Is Bank Account Churning and How Does It Actually Work?

Let’s break down the basics before we dive into the strategy.

Bank account churning is the practice of opening new bank accounts specifically to earn sign-up bonuses, then either keeping them minimally active or closing them after you’ve met the requirements and received your payout.

Here’s how it typically works: A bank advertises a promotional offer—say, “$300 bonus when you open a new checking account.” You sign up, meet their requirements (which usually involve things like making a minimum deposit or setting up direct deposit), and boom—a few weeks later, that bonus lands in your account. Once you’ve collected your cash and satisfied any account maintenance period, you’re free to close it and move on to the next opportunity.

The beauty of this approach is that banks frequently run these promotions. Chase, Citi, Bank of America, Wells Fargo—they’re all competing for customers, and they know the best way to get your attention. As someone who values both time and money, I appreciate the straightforward transaction: they want your business, you want their bonus, and everyone walks away happy.

Now, I know what you’re thinking: “Is this actually legal?” Yes, absolutely. There’s nothing illegal or morally questionable about taking advantage of offers that banks actively advertise to the public. You’re not gaming the system; you’re just being a savvy consumer who reads the fine print and capitalizes on promotional opportunities.

How Much Money Can You Realistically Make Through Bank Churning?

Let’s talk numbers, because that’s what you’re really here for, right? The earning potential with bank account churning varies wildly depending on how much effort you’re willing to put in, but here’s what you can realistically expect.

Conservative approach: If you’re just dipping your toes in and opening 3-4 accounts per year, you’re looking at roughly $600-$1,200 annually. Not life-changing, but definitely vacation money or a solid contribution to your savings goals.

Moderate approach: Ramp it up to 8-10 accounts annually, and you could easily pull in $2,000-$4,000. Now we’re talking about covering several months of rent, wiping out some debt, or seriously boosting your investment contributions.

Aggressive approach: The dedicated churners—the ones who treat this like a part-time job—can clear $5,000-$10,000+ per year. I’ve seen people document earning over $17,000 through systematic banking bonus strategies. At that level, you’re essentially creating a meaningful income stream with relatively minimal time investment.

The typical checking account bonus ranges from $200-$400, while savings account bonuses tend to fall in the $150-$300 range. Premium accounts with higher deposit requirements can offer $500-$750 or more. The key is consistency and organization—which we’ll get to in a minute.

Your Step-By-Step Game Plan for Bank Account Churning

Alright, enough theory. Let’s get into the actual process of how you’ll make this money. I’m breaking this down into clear, actionable steps that anyone can follow.

Step 1: Set Up Your Foundation

Before you start opening accounts left and right, you need to get organized. Trust me on this—trying to juggle multiple banks, deadlines, and requirements without a system is a recipe for missed bonuses and frustration.

Create a tracking spreadsheet

This is non-negotiable. Your spreadsheet should include columns for:

- Bank name

- Account type

- Opening date

- Bonus amount

- Requirements (deposit amount, direct deposit needed, debit card transactions)

- Deadline to meet requirements

- Bonus payout date, monthly fee (if any)

- Closing date

There are community templates available that people have specifically designed for bank churning, and they’re lifesavers.

Assess your starting capital

Most bank bonuses require an initial deposit ranging from $500 to $25,000, depending on the account tier. You don’t need to have this money locked up forever—usually just for 90-180 days—but you do need access to it. Start with what you can comfortably set aside without touching your emergency fund.

Check your ChexSystems report

This is like the credit report of the banking world. Banks use it to verify your banking history, and having too many recent account openings could trigger denials. You can request a free report annually from ChexSystems.com. If you’re starting fresh, you should be fine, but it’s worth checking.

Step 2: Scout the Best Current Offers

Not all bank bonuses are created equal. Some require you to do backflips, while others practically hand you money for showing up. Your goal is to target the offers with the best return on effort.

Where to find offers: Check websites that aggregate bank bonuses—they update regularly with current promotions. Doctor of Credit is particularly good for this. You can also go directly to bank websites, as they often feature their offers prominently on their homepage.

What to look for in a good offer:

- Bonus amount of at least $200 (unless requirements are extremely minimal)

- Reasonable deposit requirements relative to the bonus

- Achievable direct deposit or transaction requirements

- No monthly maintenance fees, or easy ways to waive them

- Clear timeline for when the bonus will be awarded

- No excessive account maintenance period before closing

Below is a current list of the banks, the bonuses they are offering, and the requirements.

| Bank/Product | Type | Max Bonus | Key Requirements | Notes |

|---|---|---|---|---|

| Chase Total Checking | Checking | $300 | Open and make direct deposits totaling $500 within 90 days | Nationwide, expires Jan. 26, 2026 |

| Chase Private Client Checking | Checking | $1,000-$3,000 | Upgrade/open, transfer $150k+ within 45 days, keep funds for 90 days | Tiers: $150k, $250k, $500k balances, expires Jan. 26, 2026 |

| Wells Fargo Everyday Checking | Checking | $325 | $25 opening deposit, $1,000 in electronic deposits within 90 days | Open in a branch or online, expires Jan. 14, 2026 |

| Citi Regular Checking | Checking | $325 | Open, receive 2+ direct deposits totaling $3,000 within 90 days | Expires Jan 12, 2026 |

| PNC Virtual Wallet | Checking+Savings | $100/$200/$400 | Open, receive qualifying direct deposits of $500 to $5,000+ within the first 90 days | Tiered bonus, expires |

| BMO Harris Smart Advantage | Checking | $400 | Open, receive qualifying direct deposits of $4,000+ within first 90 days | Nationwide |

| Capital One 360 Checking | Checking | $250 | Promo code, 2 direct deposits of $500+ within 75 days | No monthly fees |

| Fifth Third Bank | Checking | $300 | Open, direct deposits totaling $500+ within 90 days | Expires Jan. 7, 2026 |

| TD Bank Beyond/Complete | Checking | $200/$300 | Beyond: $2,500 direct deposits in 60 days; Complete: $500 direct deposits | Expires on |

| U.S. Bank Smartly | Checking | $250/$450 | Direct deposits of $2,000-$8,000; open online | 12-month churn language, nationwide |

| SoFi Checking/Savings | Both | $50/$300 | Direct deposit tiers: $1,000-$4,999 for $50, $5,000+ for $300 | Expires Jan. 31, 2026 |

| KeyBank Key Smart Checking | Checking | $300/$500 | Open via the bonus portal, receive $200+ direct deposit | Available in select states |

| CIT Bank Savings | Savings | $225/$300 | Deposit $25k for $225 or $50k for $300, no hold period | Direct deposit not required |

| Bank of America Advantage | Checking | $100-$500 | $2,000-$10,000 direct deposits within 90 days | Expires Jan. 31, 2026 |

Step 3: Read the Fine Print Like Your Money Depends On It (Because It Does)

Here’s where people screw up: they skim the requirements, assume they understand, then wonder why their bonus never shows up. Don’t be that person.

Key details to nail down:

- Exact deposit amount and timing

- Direct deposit requirements—and here’s the trick: many banks accept ACH transfers from other banks, PayPal, Venmo, or Cash App as “direct deposits” even if they’re not technically from an employer

- Number of debit card transactions required (if any)

- How long do you need to keep the account open before closing

- Whether you’ve received a bonus from this bank before, and if there’s a waiting period between bonuses

- Early closure fees (some banks charge if you close within 6-12 months)

One more thing: check if you’re actually eligible. Some bonuses are only for new customers, defined as people who haven’t had an account with that bank in the past 12-24 months. Applying when you’re not eligible is just wasting time.

Step 4: Open Your First Account

Once you’ve identified a strong offer and confirmed you meet the requirements, it’s time to pull the trigger. Most accounts can be opened entirely online in 10-20 minutes.

During the application:

- Use a dedicated email address for banking promotions so you don’t miss important communications

- Screenshot or save the promotional offer terms before applying

- Enter any required promo codes correctly

- Choose paperless statements (many banks require this for bonuses)

Immediately after opening:

- Set a calendar reminder for each requirement deadline

- Fund the account with the required minimum deposit

- Update your tracking spreadsheet with all relevant details

Honestly, opening the account was the easiest part for me. Doing all the research and looking at the fine print was the tough part.

Step 5: Meet the Requirements (Without Losing Your Mind)

This is the actual “work” part of bank churning, but honestly, it’s pretty minimal.

For direct deposit requirements: If you have an employer that allows you to split your paycheck between accounts, this is the easiest route. Have a small amount ($100-$500) sent to your new account for the required number of pay periods. If that’s not an option, set up ACH transfers from another bank or use services like PayPal or Cash App to push money into the account—many banks count these as direct deposits.

For debit card transaction requirements: If the bank requires 10 debit card purchases, just use the card for your normal small purchases—coffee, gas, groceries. Or get creative: buy 10 Amazon gift cards for $0.50 each. It counts.

For maintaining a minimum balance: Set it and forget it. Just keep the required amount in the account and don’t touch it until the bonus hits and the maintenance period ends.

Step 6: Collect Your Bonus and Manage the Account

Most bonuses post to your account within 30-90 days after you’ve met all requirements, though some can take up to 120 days. This is why your tracking spreadsheet is crucial—you need to follow up if a bonus doesn’t appear when expected.

When the bonus hits:

- Screenshot your account showing the bonus deposit

- Update your spreadsheet with the actual payout date

- Note when you’re eligible to close the account without fees

Account maintenance: While you’re waiting out the minimum account period, set up alerts for low balance warnings (to avoid overdrafts) and monthly fee assessments. Many people keep just above the minimum balance and set up small recurring transactions to keep the account active.

Step 7: Close the Account (Or Keep It Strategically)

Once you’ve held the account for the required period (typically 6 months is safe, though some banks specify 90-180 days), you can close it and free up your capital for the next bonus.

Closing properly:

- Transfer all but $10-$20 out of the account first

- Call the bank or visit a branch to close (most banks require this)

- Ask for confirmation that the account is fully closed with no pending fees

- Keep your final statement for tax purposes

When to keep an account open: Sometimes it makes sense to maintain an account long-term, especially if there are no monthly fees, it serves a useful purpose in your financial life, or the bank has a waiting period before you can get another bonus (keeping it open resets that clock).

Which Banks and Credit Unions Offer the Best Sign-Up Bonuses?

Let’s talk about the heavy hitters in the bank churning world. These institutions consistently offer competitive bonuses and are worth monitoring:

Top-tier for bonuses:

- Chase regularly offers $200-$300 for checking accounts with straightforward requirements

- Citi provides some of the highest bonuses ($300-$700) but often requires larger deposits

- HSBC Premier Checking offers $450+ bonuses, though requirements are more complex

- US Bank frequently has $400 checking bonuses with direct deposit requirements

- PNC Virtual Wallet reliably offers $300-$400 bonuses and is popular for annual churning

Online banks worth watching:

- SoFi Money offers up to $250 with simple requirements, great for first-timers

- Discover Online Savings features rotating bonuses with easy online signup

- Ally Bank occasionally offers savings account bonuses

- Axos Bank has creative bonus programs for online-only customers

Regional banks with strong programs:

- BMO Harris, Fifth Third Bank, Regions Bank, Huntington Bank, and M&T Bank all regularly feature $150-$400 bonuses and often have less competition than the major national banks.

The landscape changes constantly, so what’s hot today might be gone next month. Your best bet is to develop a routine of checking bonus aggregator sites weekly and jumping on strong offers when they appear.

Does Opening and Closing Multiple Bank Accounts Affect Your Credit Score?

Here’s some good news: bank account churning has essentially zero impact on your credit score. Let me explain why.

Opening a checking or savings account doesn’t involve a hard credit inquiry. Banks use ChexSystems or Early Warning Services to verify your banking history, not your credit report. These are completely separate systems. So you can open 10 bank accounts in a year, and your credit score won’t budge (at least not from the account openings).

Closing accounts also doesn’t directly affect your credit score because deposit accounts don’t appear on your credit report in the first place. Your credit report tracks loans, credit cards, and credit-related payment history—not your checking and savings accounts.

The exception: If you overdraft an account and it goes to collections, that absolutely will damage your credit. But as long as you’re managing your accounts responsibly and not overdrafting, you’re in the clear.

What about ChexSystems? That’s a different concern. Opening too many accounts in a short period can raise flags in the ChexSystems database, potentially leading to denials from new banks. Most experts recommend keeping it to 6-8 new accounts per year maximum to avoid this issue. Space out your applications, and you’ll be fine.

The Risks and Downsides You Need to Know About

Alright, real talk time. While bank churning is low-risk compared to most money-making strategies, it’s not without potential pitfalls. Here’s what could go wrong and how to avoid it.

Getting blacklisted: Some banks track bonus recipients and may deny you future bonuses or even refuse to open accounts if they think you’re churning too aggressively. Chase is notorious for this—violating their internal rules can get you banned from all Chase products. The solution? Follow the rules precisely and don’t try to cheat the system by using multiple identities or hiding past bonuses.

Missing requirements and losing bonuses: This is the most common mistake. You think you met all the requirements, but you missed one small detail, and the bonus never arrives. The fix is simple but requires discipline: meticulous tracking and setting multiple calendar reminders.

Monthly maintenance fees: If you’re not careful, those $12-$25 monthly fees can eat into your bonus profits. Always know how to waive the fees (usually by maintaining a minimum balance or having direct deposit) or factor them into your calculations.

Tax implications: Those bonuses are taxable income. Banks will send you a 1099-INT form if you earned $10 or more in bonuses from them during the year. Set aside roughly 20-30% of your total bonuses for taxes, depending on your bracket. Yes, it sucks, but you’re still coming out ahead.

Capital tied up: Your money is locked in these accounts while you’re meeting requirements. If you’re using funds you might need for emergencies, you’re playing with fire. Only churn with money you can afford to set aside for 3-6 months.

Time and mental energy: Managing multiple accounts, tracking deadlines, and ensuring requirements are met takes organization and attention. If you’re already stretched thin, adding this to your plate might create more stress than the money is worth.

How to Keep Track of Multiple Accounts, Requirements, and Deadlines

I cannot stress this enough: organization is everything in bank churning. The difference between making $3,000 and making $500 often comes down to how well you’re tracking your activities.

Your essential tracking system should include:

A master spreadsheet with every account you’ve opened or plan to open. Use color coding—green for bonuses received, yellow for requirements in progress, red for potential issues.

Calendar reminders set for every important date: when direct deposits need to hit, when debit card transactions need to be completed, when bonuses should post, and when you can safely close accounts.

A dedicated folder (physical or digital) for all bank communications, screenshots of offers, bonus payout confirmations, and closing confirmations.

Tools that help:

- Google Sheets or Excel for your master tracking spreadsheet

- Google Calendar for deadline management

- A dedicated email address for banking (keeps your main inbox clean)

- Apps like Mint or Personal Capital to monitor all accounts in one place

- Screenshot tools to capture offer terms before applying

Some churners use project management tools like Notion or Trello to track their churning pipeline—accounts they’re researching, accounts they’ve applied for, accounts in the requirement phase, and accounts ready to close. Find what works for your brain.

Can Students or People with Small Emergency Funds Do This Safely?

Short answer: yes, but with caution and modified expectations.

If you’re a student or someone without a large cash cushion, you can absolutely participate in bank churning—you just need to be more selective about which offers you pursue. Look for bonuses with lower deposit requirements ($500-$1,500 instead of $15,000) and shorter maintenance periods.

Good starter options for those with limited capital:

- Chase Total Checking typically requires just $500 in deposits for a $300 bonus

- SoFi Money offers $250 with no minimum deposit, just direct deposit requirements

- Discover Online Savings occasionally offers $150-$200 bonuses with small minimum deposits

Safety guidelines for smaller budgets:

- Never churn with your last dollar or your entire emergency fund

- Start with just one or two accounts to learn the process

- Choose banks with no monthly fees or very easy fee-waiver requirements

- Avoid offers requiring you to keep large balances locked up for extended periods

- Consider business account bonuses if you have any side income (these often have better terms)

The key is scaling appropriately. Don’t feel pressure to chase every $500 bonus requiring $25,000 deposits if that’s not your reality. There’s plenty of money to be made at the lower tiers.

Tax Implications: What You Need to Report

Let’s address the part everyone wants to ignore but absolutely cannot: taxes.

Bank account bonuses are considered taxable interest income by the IRS. Each bank that pays you $10 or more in bonuses during a calendar year will send you a Form 1099-INT, typically by January 31st of the following year. This form reports exactly how much you earned, and the IRS gets a copy too, so there’s no hiding it.

What you need to do:

- Keep records of every bonus you receive throughout the year

- When you file taxes, report all bonus income even if you didn’t receive a 1099 (you’re required to report all income)

- If you’re earning substantial money from churning (say, $3,000+), consider making quarterly estimated tax payments to avoid underpayment penalties

How much will you actually owe? That depends on your tax bracket. If you’re in the 22% federal bracket and earn $3,000 in bonuses, expect to owe roughly $660 in federal taxes, plus any state income tax. Still profitable, but worth factoring into your calculations.

Pro tip: Since taxes will take a bite, mentally adjust your bonus targets upward. If you want to clear $2,500 after taxes, you need to earn about $3,200-$3,500 in bonuses depending on your bracket.

Your First 30 Days: A Practical Getting Started Plan

Ready to actually do this? Here’s your concrete action plan for the first month.

Week 1: Setup and Research

- Request your ChexSystems report to understand your starting position

- Create your tracking spreadsheet with all necessary columns

- Research current top bank bonus offers on aggregator sites

- Set up a dedicated email for banking promotions

- Calculate how much capital you can comfortably allocate

Week 2: Your First Application

- Choose one strong offer with straightforward requirements (I’d suggest starting with Chase or SoFi)

- Carefully read all terms and save screenshots

- Complete the application

- Fund the account immediately after approval

- Set calendar reminders for all requirement deadlines

Week 3: Meeting Requirements

- Set up direct deposit or ACH transfers to satisfy requirements

- Complete any debit card transactions needed

- Monitor the account to ensure everything processes correctly

- Research your next target offer while waiting

Week 4: Second Application and Planning

- Apply for a second account with a different bank

- Update your tracking system with progress on Account #1

- Begin planning your next 2-3 applications for the following months

- Join online communities (like r/churning on Reddit) to learn from experienced churners

Following this timeline keeps you from getting overwhelmed while building momentum. After your first bonus hits, you’ll have the confidence and experience to scale up.

Final Thoughts: Is Bank Account Churning Worth Your Time?

Look, I’m not going to tell you that bank churning is going to replace your day job or solve all your financial problems. But as side hustles go, it’s one of the most straightforward and lowest-effort ways to generate meaningful extra income.

The math is simple: if you can dedicate 5-10 hours per month to managing accounts and meeting requirements, earning $3,000-$5,000 annually is totally achievable. That’s an effective hourly rate of $50-$100, which beats the hell out of most side gigs.

The strategy works because you’re taking advantage of an ongoing reality in the banking industry: customer acquisition is expensive, and banks have determined that paying cash bonuses is an effective marketing investment. As long as banks compete for customers, these opportunities will exist.

Start small, stay organized, and be consistent. Your first bonus might take a few months to hit, but once it does and you see that extra $300 in your account, you’ll understand why thousands of people have turned this into a reliable income stream.

Now stop reading and go open your first account. That money isn’t going to earn itself.

Ready to start churning? Begin by checking your ChexSystems report and researching current Chase and Citi offers—these are consistently among the best starting points for new churners. Track everything, meet every requirement, and watch your account balance grow. You’ve got this.